Remember the good old days of gathering around the TV for a must-watch network show? For a while, it seemed like those days were fading into oblivion, swallowed whole by the seemingly insatiable beast of streaming services. Netflix, Hulu, Max, Disney+, Amazon Prime Video – the list of OTT platforms grew exponentially, and with it, the narrative that linear TV was on its deathbed.

But hold on a minute! In 2025, a fascinating shift is underway. While streaming continues to dominate overall viewing time, particularly among younger demographics, network TV (broadcast and cable combined) is showing surprising resilience and, in some key areas, even hinting at a subtle comeback. It's not the comeback of old, but an adaptation that showcases the enduring power of traditional broadcasting. Let's dig into what the ratings are telling us about the future of television.

The Shifting Landscape: Streaming's Continued Reign

Before we talk about any kind of comeback, it's crucial to acknowledge the current reality: streaming is king. According to Nielsen's May 2025 “The Gauge” report, streaming officially surpassed the combined share of broadcast and cable for the first time ever, accounting for 44.8% of total TV viewership. This is a significant milestone, reinforcing the massive shift in how people consume content.

- Dominant Growth: Streaming usage has increased by a staggering 71% since May 2021.

- More Platforms: The number of streaming services with a significant share of TV usage has expanded to 11, up from just 5 in May 2021.

- Cord-Cutting Continues: The trend of households canceling traditional cable TV subscriptions shows no signs of slowing down, driven by cost savings and the convenience of on-demand content. By 2026, it's estimated over 80 million U.S. households will have cut the cord.

So, if streaming is growing and cord-cutting is rampant, how can network TV possibly be making a comeback? The answer lies in adaptation, strategic strengths, and a nuanced look at what people are still watching.

Network TV's Resilience: The Power of Live and Local

Despite the overall decline in linear TV viewership (broadcast down 21% and cable down 39% compared to May 2021), broadcast and cable have shown “surprising resilience.” This resilience isn't about competing head-on with streaming's massive libraries of on-demand content. It's about leveraging their unique strengths: live events, news, and targeted content.

1. Live Sports: The Undisputed Anchor

- Appointment Viewing: Live sports remain the single biggest draw for linear TV. Major events like the Super Bowl, NFL games, and the Paris Olympics continue to deliver massive audiences to networks like CBS and NBC in 2025. These are truly “appointment viewing” events that bring people together in real-time.

- Massive Audiences: While overall viewership is down, individual major sporting events can still command tens of millions of viewers, a feat rarely achieved by even the most popular streaming originals on their premiere nights.

- Shifting Rights: While streaming platforms like Netflix (with WWE Raw and NFL Christmas Day games) and Amazon (with NFL Thursday Night Football) are aggressively entering the live sports arena, the vast majority of major sports rights are still held by traditional networks. This creates a push-pull where networks are adapting to streaming, but also leveraging their continued exclusive access to top-tier sports.

2. News and Special Events: Timeliness and Trust

- Breaking News: When major national or global events unfold, viewers still instinctively turn to broadcast news channels for live, immediate, and often trusted information.

- Political Coverage: Election cycles, debates, and political events continue to be significant drivers of viewership for network news.

- Awards Shows & Cultural Moments: While their ratings have fluctuated, major awards ceremonies, reality competition finales, and other cultural events still often find their largest live audiences on network TV.

3. Hyper-Local Content: Connecting with Communities

- Local News: In an increasingly globalized and digital world, the demand for hyper-local news remains strong. Network affiliates continue to be a primary source for community-specific information, weather updates, and local sports.

- Community Engagement: Broadcasters are realizing the value of serving their immediate communities, producing stories that resonate with local experiences and regional identity. This fosters a sense of connection that global streaming platforms often can't replicate.

Adapting to the Streaming Era: Innovation from Within

Network TV isn't just passively riding out the storm; it's actively adapting.

- Hybrid Models & FAST Channels: Many traditional broadcasters are embracing Free Ad-Supported Streaming Television (FAST) channels. These platforms (like Pluto TV, Tubi, The Roku Channel) offer a linear, schedule-based viewing experience with ads, much like traditional TV, but delivered over the internet without a subscription. They often feature library content (classic shows like Suits, NCIS, Grey's Anatomy), which audiences are increasingly flocking to. This shows networks finding new ways to monetize their vast content libraries and reach cord-cutters.

- NextGen TV (ATSC 3.0): This new broadcast standard is breathing new life into over-the-air TV. It supports 4K resolution, immersive audio, targeted advertising, and real-time interactivity, making broadcast content competitive with digital standards. This is a game-changer for picture quality and personalized ad delivery.

- Digital-First Workflows: Many TV stations are shifting to “digital-first” mentalities, expanding their news coverage onto OTT delivery systems like Apple TV and Roku, and providing more content specifically tailored for social media platforms.

- Content Strategy: Networks are focusing on high-quality, targeted content that can generate buzz and potentially find life on streaming services after its initial broadcast run. They're also exploring innovative monetization models beyond traditional ad breaks.

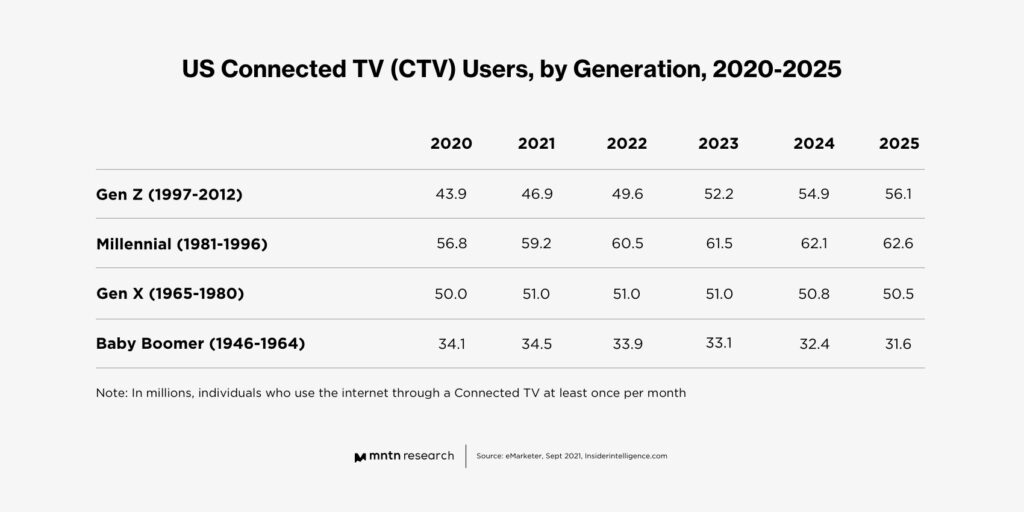

The Demographics Tell a Story

While older demographics (55-64+) are significantly more likely to watch linear TV, and spend more time doing so, there's a fascinating nuance. Younger audiences (16-24) are the most likely to watch some form of television each month (98%), even if streaming accounts for most of their viewing time. This suggests that while traditional network viewing habits are changing, TV content itself remains universally popular.

Conclusion: A Resilient Ecosystem, Not a Monarchy

Is network TV making a comeback in the way it once dominated the media landscape? No, not in terms of overall viewership share. Streaming has fundamentally altered the game, and its growth trajectory is undeniable.

However, calling it a “comeback” isn't entirely inaccurate when you consider its strategic resilience. In 2025, network TV is proving it's not going anywhere. It's evolving, leveraging its unique strengths in live sports, breaking news, and local content, while simultaneously innovating with FAST channels and new broadcast technologies.

The ratings tell us that the television ecosystem is becoming a diverse, multi-platform environment. There isn't one single “winner,” but rather different players excelling in different arenas. For consumers, this means more choices and more ways to engage with the stories and events they care about. So, while your parents might still be glued to their favorite nightly newscast, and you might be binging a new series on a streamer, the influence and strategic value of network television remain incredibly strong. It's not a resurgence to former glory, but a smart and powerful adaptation that secures its place in the vibrant future of entertainment.