For generations, farmers have been at the heart of feeding the world, yet many have struggled to access the most basic financial services. Traditional banks often avoid lending to smallholder farmers because of high risks, lack of collateral, and the remote locations where many live. The result? Millions of farmers are left without access to loans, insurance, or savings facilities.

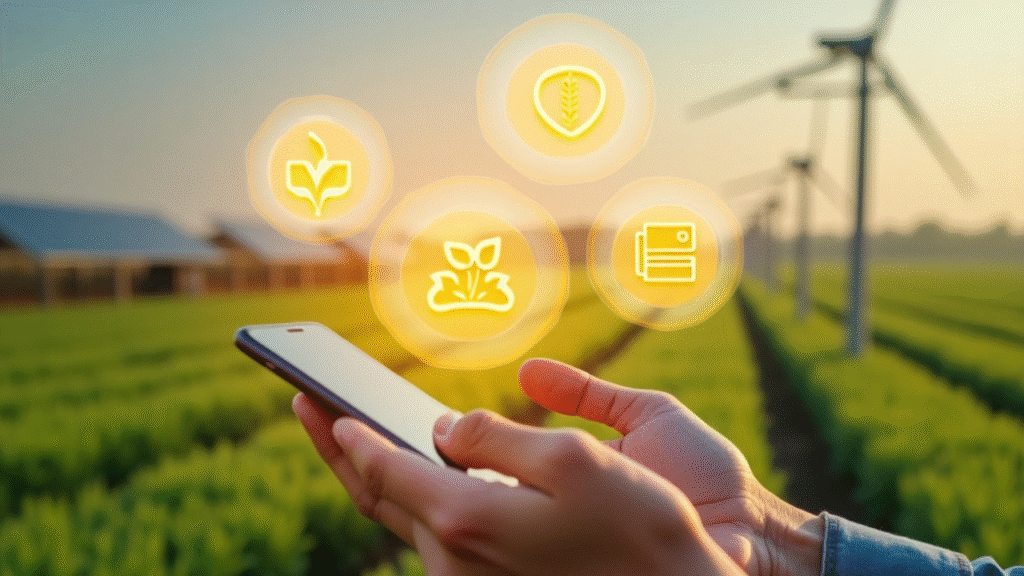

This is where Digital Microfinance in Agriculture steps in. Powered by fintech in agriculture, digital microfinance is giving farmers access to affordable credit, crop insurance, and secure savings—all through their mobile phones. From India to Kenya to Latin America, these innovations are helping farmers grow more, earn more, and build resilience for the future.

Let’s explore how digital financial services for farmers are driving change and how fintech is empowering rural farmers in today’s digital age.

What is Digital Microfinance in Agriculture?

Microfinance for farmers refers to small-scale financial services—like loans, savings, and insurance—tailored for rural communities that traditional banks often overlook. When combined with digital technology, these services become faster, more affordable, and more accessible.

Instead of waiting in long bank queues or depending on informal moneylenders, farmers can now:

- Apply for digital loans for farmers via mobile apps.

- Save money securely in digital wallets in agriculture.

- Pay insurance premiums with mobile payments.

- Receive instant payouts after crop failures or natural disasters.

In short, digital microfinance in agriculture is putting financial power into the hands of smallholder farmers.

Why Farmers Need Digital Microfinance

Smallholder farmers, who produce more than 70% of the world’s food, often face these challenges:

- Limited Access to Credit: Banks hesitate to lend without collateral.

- High Interest from Informal Lenders: Many farmers borrow at unfair rates.

- Lack of Insurance: A single bad season can ruin their livelihoods.

- Geographical Barriers: Farmers in remote areas may live hours away from the nearest bank branch.

By bringing agricultural fintech solutions directly to their mobile phones, digital microfinance is solving these problems and promoting rural financial inclusion.

Fintech in Agriculture: Key Innovations Driving Change

a) Mobile Banking for Rural Farmers

With mobile banking apps, farmers can save money safely, transfer funds, and receive digital payments for their crops. This eliminates the need to carry cash, reducing theft risks.

b) Digital Loans for Farmers

Agri-fintech innovations use AI and satellite data to assess creditworthiness. Farmers can apply for microloans and receive approval within minutes. These loans help buy seeds, fertilizers, or machinery.

c) Digital Wallets in Agriculture

Digital wallets let farmers store money securely and pay for farming inputs at shops that accept mobile payments. They also make it easier for governments to send subsidies directly to farmers.

d) Crop Insurance and Microfinance

Insurance is becoming more accessible through apps that offer weather-indexed insurance policies. If rainfall or temperature falls outside normal conditions, farmers are automatically compensated.

Benefits of Digital Microfinance in Agriculture

The shift to digital financial services for farmers brings multiple advantages:

- Financial Inclusion – Farmers without bank accounts gain access to affordable services.

- Empowerment – By accessing credit, farmers can invest in better seeds, fertilizers, and tools.

- Risk Management – Crop insurance and microfinance protect farmers from climate shocks.

- Efficiency – Digital platforms reduce paperwork and speed up loan approvals.

- Transparency – Transactions are secure, recorded, and traceable.

Case Studies: Digital Microfinance Success Stories

1. India: Mobile-Based Credit for Farmers

Apps like BharatAgri and PayAgri connect farmers with lenders and provide digital loans for farmers. These platforms also offer crop advisory services, making them “one-stop shops” for farmers.

2. Kenya: M-Pesa and M-Shwari

Kenya is a global leader in mobile banking for rural farmers. M-Pesa allows farmers to receive payments digitally, while M-Shwari provides small loans that farmers repay after selling their crops.

3. Latin America: Agri-Fintech Growth

In Brazil and Mexico, agricultural fintech solutions are combining microloans with digital marketplaces, enabling farmers to both borrow money and find buyers for their produce.

Challenges in Digital Microfinance Adoption

Despite progress, there are still barriers:

- Digital Literacy: Some farmers struggle to use mobile apps.

- Connectivity Gaps: Rural areas may lack reliable internet access.

- Trust Issues: Farmers used to cash may hesitate to adopt digital wallets.

- Affordability: Even small transaction fees can discourage adoption.

Bridging these gaps will be key to making microfinance for farmers universally accessible.

The Future of Agricultural Fintech Solutions

The next decade will see even more exciting agri-fintech innovations:

- AI-Powered Credit Scoring – Using farm data and weather history to predict repayment ability.

- Blockchain for Transparency – Ensuring fair pricing and secure transactions.

- Integrated Super Apps – Combining loans, insurance, weather forecasts, and marketplaces in one platform.

- Voice-Based Mobile Apps – Helping farmers who cannot read or write access services through voice commands.

As technology advances, digital microfinance in agriculture will become smarter, faster, and more farmer-friendly.

Conclusion: Growing Prosperity with Digital Microfinance

Digital microfinance in agriculture is not just about money—it’s about empowerment, resilience, and hope. By providing farmers with access to digital loans, mobile banking, and crop insurance, fintech is transforming rural challenges into opportunities.

From microfinance for farmers in Africa to digital agricultural finance in Asia, the trend is clear: fintech is helping to build a more inclusive, sustainable, and prosperous agricultural future.

In simple terms, fintech is empowering rural farmers to grow more than crops—they’re growing opportunities, stability, and brighter futures for their families and communities.